Folks,

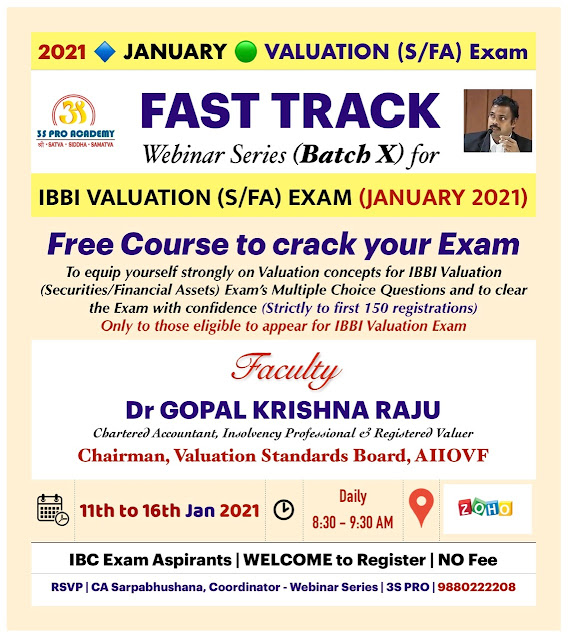

Herewith I have given below the link for Batch X - Day 3 - Presentation made in Fast Track Webinar Series for IBBI Valuation Exam (SFA) on "Intangible Assets Valuation"

Intangible Assets - (Minimum 7 Marks)

- Nature and classification of intangibles

- Identification of nature of intangible assets: life of asset; based on function; acquired or internally generated; generating cash flow independently or not generating cash flow independently; intangible assets under development and research assets

- Purpose of intangibles valuation: financial reporting under Ind AS, legal and tax reporting, estate and gift tax, amortization allowance, transfer of standalone intangible assets, transfer of intangible asset as part of transaction, collateral lending, franchises and brand license agreement, insolvency/ bankruptcy

- Valuation Approaches: excess earnings method; relief-from-royalty method; premium profit method; greenfield method; distributor method; other valuation approaches as applicable; rate of return and discount rate for intangibles

- Minimum 7 marks | Material to Read: ICAIRVO_VS: 302 ; IVS: 210 ; IND AS 38 | Technical Guide to Valuation (ICAI): Page 45 to 61 | Meaning of IA; Measurement, Recognition, Exchange of IA | Types of IA | Income Approach, Cost Approach, Market Approach |Purpose of Valuation of IA

- After investing substantial amount of time and Himalayan size of Efforts, Research & Pain; this material is brought out.

- Your acknowledgement (with your name, location & contact no) in this blog by few words will be an encouragement for this Hard Work

Link for GKR Material on Valuation of Intangible Assets (PDF):

Link for IND AS 38 - MCA (PDF)

Link for GKR Exel Worksheet on Bottom-up Beta

Kindly post your comments, suggestions, queries & review of the webinar session below this post

Happy Reading | Please contact Dr S Dhanapal (96770 22712) / CA Sarpabhushana (98802 22208) for being part of FT10 WhatsApp group.

Dr GKR

15th January 2021

Friday